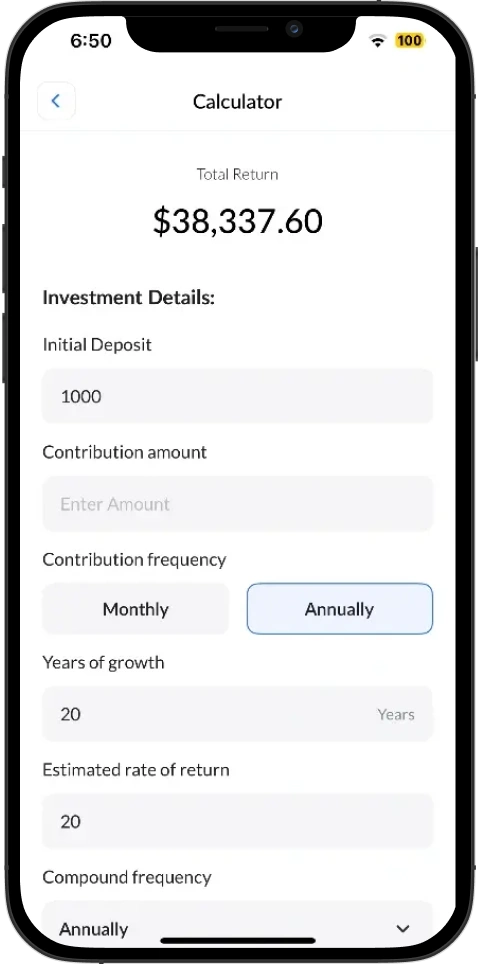

Access Elite Strategies Without $1M+ Minimums, % Fees, Or Confusion — Start With as little as $1000

Download Openvest. Pick our once exclusive, battle-tested strategies in minutes. Pay $5/month max flat. Cancel anytime. Custody with Interactive Brokers (NYSE, FINRA, SIPC).

Currently available in all U.S. regions.

Not in one of these states? : Join Waitlist to Get Access Soon!Influencer? Join our : Affiliate Program!