Key Points:

- Start Early and Stay Consistent

- Minimize Costs to Maximize Returns

- Compounding in all Facets of Life

1,440 Americans across the millennial, Generation X and baby boomer generations offered surprising insights into how the millennials view money and investing and how those views often differ markedly from previous generations. More than half of millennials surveyed feel overwhelmed by financial obligations, compared with 39% of Gen Xers and 31% of boomers. Building up an emergency fund is a focus for 60% of those between the ages of 23 and 38, compared with much lower numbers in prior generations. Half of millennials say they want to invest but have no idea where to begin, compared with 32% of Generation X. Thus, in a world where the stark realities of financial pressures remain, how can generations such as Millenial and Gen Z start investing to mitigate capital stress?

The common notion is that continuous turmoil in the market could add to millennials’ hesitation in entrusting their money to the market and taking on risk. However, the concept of risk is often greatly misunderstood. Volatility on its own is not a risk. Risk is simply the probability of permanent capital loss. In other words, if you invest $100 and the Sharpe Ratio (measure of return for the level of risk taken) is less than 1, then the return is not sufficient for the amount of risk taken. Between 1-2 is acceptable and great 2 or above is considered very good. There are limitations to the Sharpe Ratio.

First, this assumes a normal distribution whereas real-world returns exhibit fat tails (skewness or kurtosis for the statistics lovers).

Second, the Sharpe Ratio does penalize all volatility. In other words, the Sharpe Ratio treats upside and downside volatility equally, which, in fact, does not align well with investor preferences. Investors tend to fear losses more than they appreciate gains.

Third, the Sharpe Ratio is a single-period measure (i.e. snapshot) and may not accurately reflect changing market conditions. Although the Sharpe Ratio is one helpful measure, this is just one proxy. Risk must be understood from a more permanent perspective rather than short term fluctuations. Warren Buffett has echoed similar thoughts over the years, saying that “risk comes from not knowing you are doing” and by saying “Volatility is not the same risk.”

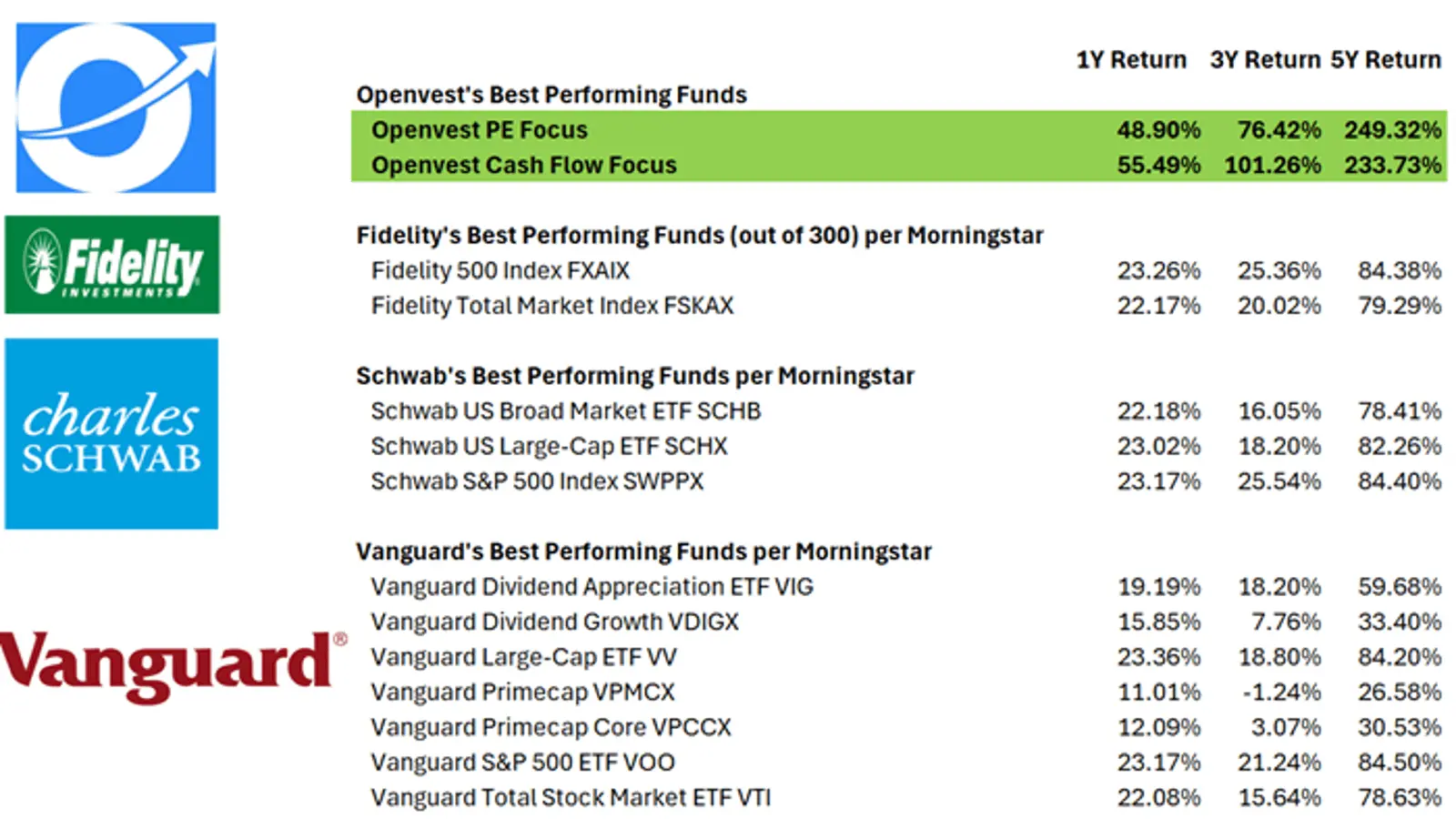

Gen Z’s and Millennials who have neither the time, the required expertise, nor the money to pay very expensive fees should use other low-cost, value-based platforms that provide very good investment performance at a fraction of the cost of other investment platforms. Moreover, these other platforms all offer a similar version of the same exact thing: standard Mutual Funds or ETFs with a fee on top such as an AUM Fee for the platform.

Read more: how to start investing with $1,000

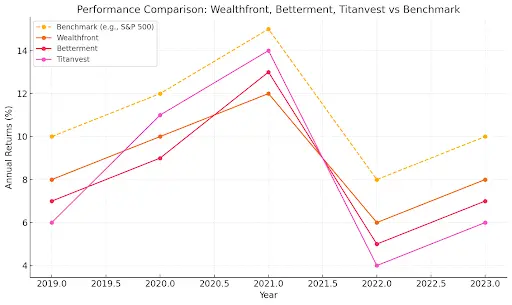

One easy way to evaluate this is to ask yourself if the likes of Wealthfront, Titan Vest or Betterment are really adding value to your investments? Current bond yields at Betterment are offering 5.72%. The S&P 500 index alone has achieved 28%+ as of Dec 16, 2024. So why the hell would anyone put money in bonds or fixed income strategies offering such low yields? Bottom line, set some money aside to invest, and use the rest of the money you need today. Going back to the understanding of risk, bonds are not necessarily safer. To the contrary, bonds might actually cause more risk to you (opportunity cost of forgone capital appreciation) over time.

Keep in mind that this is a comparison versus the S&P 500, which is the standard benchmark index in the United States.

One other item to keep in mind is that the platforms above all charge some version of either an AUM Fee or some overly expensive subscription (apparently Titan has decided to charge $25 per month starting in 2025). $25 per month? For what? Underperforming a benchmark?

At some point, the value provided via a lower-cost platform such as Openvest will come to circumvent the higher-cost, lower-returning platforms because at the end of the day, each platform is judged by the value they bring to their investors. If platforms in one given industry all offer the same standard solutions that are mediocre in nature due to their lower performance plus a fee charged, how does that help anyone?

The graph below demonstrates the performance that would have taken place had the platform started at the beginning of 2019 up to and up to June 26, 2024.