Key points to consider:

- Concentrated Portfolios Amplify Compounding Growth

- Over-Diversification Dilutes Returns

- Younger Investors Benefit from Focus

Younger investors with concentrated investments in a few companies or industries are better at building vast wealth. A more concentrated portfolio also enables investors to focus on a manageable number of high-quality investments.

One of the benefits of a more concentrated portfolio is that it increases potential gains. Investment portfolios that obtain the highest returns for investors are not widely diversified. This categorical truth is unquestioned as it relates to investing. Although diversification may make sense up to a certain point (i.e. don’t just invest in 1 single company without understanding highly volatile swings), holding too many investments will certainly detract from your returns rather than add to them.

For instance, consider an investor who spreads their portfolio across 50 stocks, such as most mediocre institutional funds. While this may reduce the risk of any single stock performing poorly, it also dilutes the impact of top-performing investments. In contrast, an investor with a concentrated portfolio of, for example, 2 high-quality investments can achieve significantly higher returns and build vast wealth as those holdings outperform.

Let’s illustrate this with numbers:

Imagine an investor with $10,000 to allocate. If they split their investment across 50 stocks, each stock gets $200. Let’s assume 5 of these stocks are high performers that grow at a 20% annualized rate, while the rest grow at an average rate of 8% annually. After 10 years, the $200 allocated to the high performers grows to $1,238 each, while the $200 in the other stocks grows to $432 each. In total, the portfolio grows to about $34,000.

Now, compare this to an investor who concentrates their $10,000 in just two high-performing stocks, each growing at 20% annually. After 10 years, each $5,000 investment grows to $30,950, making the total portfolio worth $61,900. That’s nearly double the return of the diversified portfolio in the same timeframe.

This example highlights the power of compounding in a concentrated portfolio. By focusing on a small number of high-quality investments, the gains from top performers are amplified, accelerating wealth accumulation significantly.

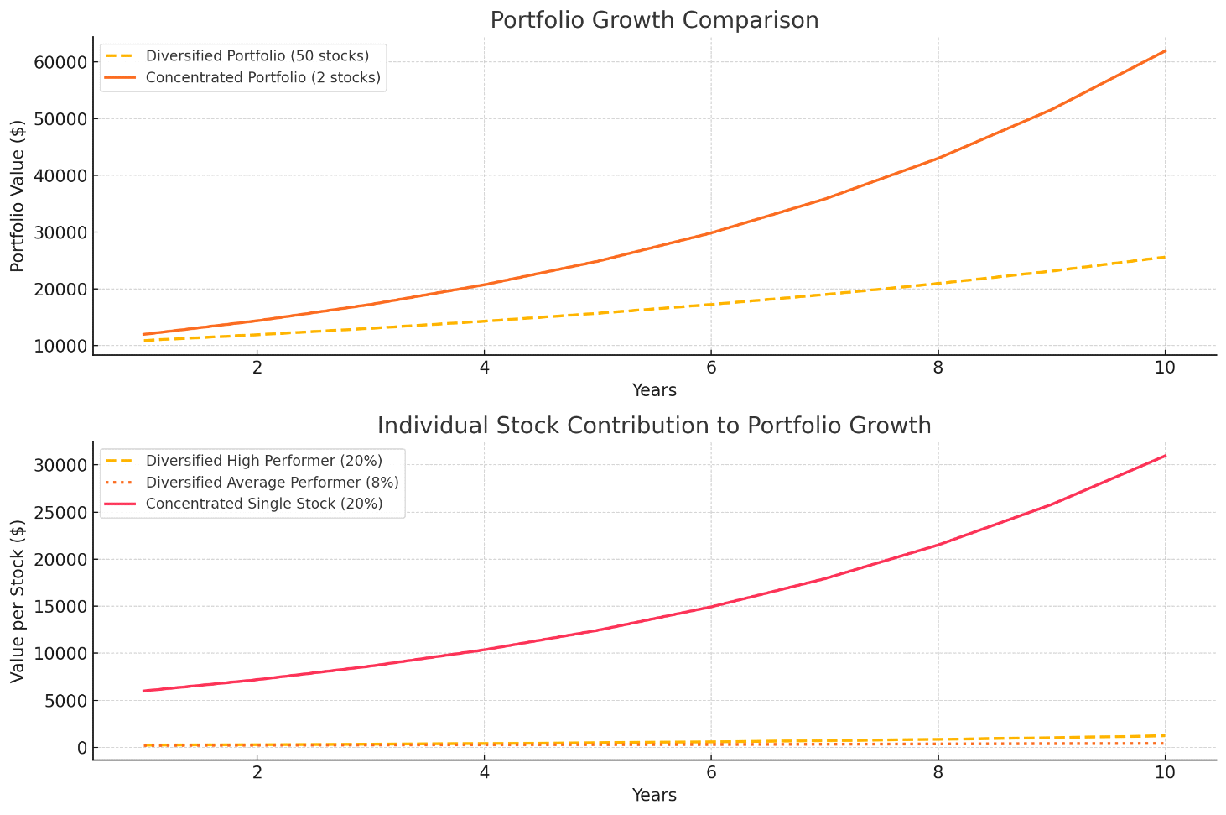

The graphs above compare the growth of a diversified portfolio versus a concentrated portfolio over 10 years:

Top Graph: Total Portfolio Growth

- The diversified portfolio (50 stocks: 5 high performers at 20% and 45 average performers at 8%) grows to approximately $34,000.

- The concentrated portfolio (2 high-performing stocks at 20%) grows to $61,900, nearly doubling the diversified portfolio's total value.

Bottom Graph: Individual Stock Contributions

- Diversified High Performers (20% growth) contribute significantly but are diluted by the larger number of average performers (8% growth).

- Concentrated Portfolio Stocks (20% growth each) show exponential growth without dilution, leading to a higher portfolio value overall.

These visualizations highlight how focusing on a smaller number of high-quality investments can dramatically amplify returns over time.

Explore more: Investment App Pitfalls

Longer Time Horizon Amplifies Returns

Younger investors, typically anyone under 60, should consider diversifying less, as a less diversified portfolio can significantly amplify long-term returns. This approach leverages their longer time horizon, which allows them to recover from potential losses and capitalize on high-growth opportunities. For example, a 30-year-old investing $10,000 in just two high-growth stocks with annual returns of 20% would see their portfolio grow to approximately $2,373,763 over 30 years. In contrast, a diversified portfolio with an average return of 8% would grow to only $100,627 in the same timeframe. The concentrated approach generates 23x more wealth, demonstrating the compounding power of focusing on high-quality investments during the wealth-building years.

Over-Diversification Dilutes Returns

Over-diversification often dilutes returns without providing substantial additional risk reduction. Research indicates that portfolios with 20-30 holdings capture most of the benefits of diversification. Beyond this point, adding more investments minimally reduces risk while significantly diluting returns. For instance, in a portfolio of 50 stocks with an average return of 8%, where only 10% of the holdings perform at 20%, the overall portfolio return would average just 9.2%. Comparatively, a concentrated portfolio achieving a consistent 20% annual return would compound a $10,000 investment into $383,376 over 20 years, far outperforming the diversified portfolio's $65,590.

Focus Enables Better Decision-Making

Additionally, holding fewer, high-quality investments enables investors to focus more on understanding their portfolio, avoiding poor decisions influenced by market noise. For younger investors, this concentrated approach not only aligns with their ability to take calculated risks but also offers the best chance to achieve exceptional long-term growth. Diversification, while a useful tool, should be employed strategically, not excessively, for those aiming to build vast wealth over time.

The chart below shows returns of a portfolio of 100 companies within the S&P 500 with high ROIC vs the index itself. It is only an illustrative back test used to make a point, and not an actual trading system. The algorithm ranks the companies within the S&P500 by ROIC and buys into the “best 100” companies only when they are reasonably valued.